2025 UK CEP Market Outlook

Read also …

2025 UK CEP Market Outlook

Published on 28/08/2025

Thanks to CEP-Research GmbH for publishing our analysis of the parcel market in the UK📦📦 !

Looking ahead to 2025, projections from we anticipate a 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐠𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 6.8% 𝐟𝐨𝐫 𝐁𝟮𝐂+𝐂𝟮𝐗 (split by segments available upon request).

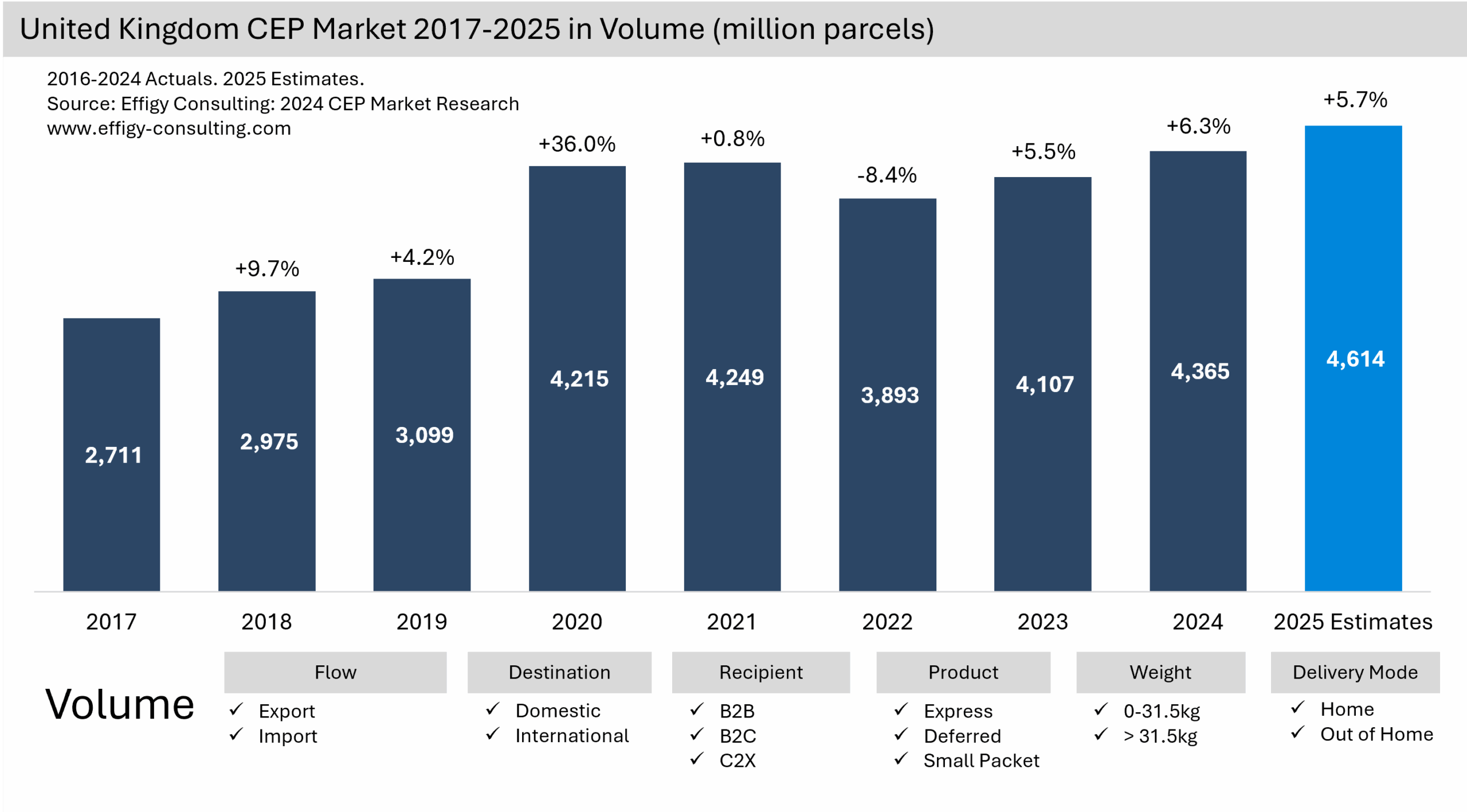

The UK courier, express and parcels (CEP) market is generating healthy mid-single-digit volume growth rates, according to new research by our content partner Effigy Consulting.

Cruising Speed Returns for Europe’s Most Mature eCommerce Market

Following years of hypergrowth during the COVID period, and a post-COVID correction, the 2024 figures confirm entry into a phase of moderate growth. UK eCommerce revenues grew between 4.2% and 4.5% in 2024 — a slight dip compared to 2023 (4.8%) but consistent with the dynamics of a mature market. Real volume growth is estimated at 1.95%[1]. This indicates that UK consumers did not significantly increase their online purchasing volumes. Revenue growth was largely due to higher average prices.

In comparison, the rest of Europe shows stronger momentum, with expected CAGR of 6.2% in revenue and 4.0% in volume for the 2024–2028 period. This more modest growth is not alarming; it simply confirms the UK’s position as Europe’s most mature eCommerce market, with a penetration rate now reaching 30.4% of total retail sales. Reflecting this maturity, eMarketer forecasts only minor increases in penetration (<1% per year between 2025 and 2028). Such maturity logically implies lower growth, as the market has already absorbed much of its growth potential.

A More Dynamic Parcel Market Than eCommerce

Parcel delivery tells a different story. In 2024, parcel volumes in the UK rose by 6.3% (Effigy Consulting data) — a faster pace than in Germany, France, the Netherlands, or the BeLux region. The B2C segment linked to eCommerce stood out in particular, growing by 6.8%.

This difference between moderate eCommerce revenue growth and stronger parcel volume growth raises questions. Several scenarios may explain it: increased purchasing frequency, declining average basket size, rising influence of low-value models (second-hand, discount, subscriptions), or greater shipment fragmentation.

Who is outgrowing the market?

We observe multiple operators growing above the B2C eCommerce average of 6.8% in 2024[2]: Amazon, DHL eCommerce, DX, Evri, InPost, Royal Mail (detailed data per operator and segment available from Effigy Consulting). This makes the UK one of the most competitive delivery markets in Europe — not to mention recent months, which have seen notable M&A projects (Evri/DHL eCommerce and InPost/Yodel).

For Amazon, we estimate marketplace order volume growth of over 10% in 2024 — with a growing share delivered via its own network. Capacity growth in its delivery network exceeds the market average, confirming Amazon’s diversion of volume away from traditional partners. In 2024, more than half of its parcels were delivered through its own last-mile solutions.

Regarding Evri + DHL eCommerce, this merger will result in an entity handling nearly 900 million parcels — the UK’s third-largest B2C delivery operator and the leading operator in C2X (Effigy Consulting data).

The InPost + Yodel merger will result in an operator handling around 300 million parcels — ranking as the UK’s fifth-largest B2C delivery operator and the third in C2X (Effigy Consulting data).

Promising Prospects for 2025

We forecast parcel market growth of 5.7% in 2025 (volume). This includes a 6.4% rise in B2C, a similar trend in C2B, and an outperforming C2C segment driven by the second-hand market.

However, eCommerce indicators show mixed signals. Some sources (e.g. IMRG) report a near-stagnant market in volume compared to 2025. This reflects pressure on UK household purchasing power observed in Q1 2025: the Office for National Statistics (ONS) confirmed that real disposable income per capita fell by 1% in Q1 2025 — despite nominal wage growth of 5.9%, offset by higher taxes, levies, and 3.1% inflation.

We estimate that out-of-home (OOH) delivery accounts for 6–8% of B2C volumes (first-attempt delivery only — first mile excluded). As elsewhere in Europe, this segment is growing strongly — though a recent 2025 DHL study presented lower consumer preference according to the latest DHL barometer (68% of UK consumers prefer home delivery vs. 54% average in Europe — including 60% in Germany and 53% in France)[3].

eCommerce Sector Dynamics

According to a 2025 study (based on 2024 data) by the Office for National Statistics, the top 5 eCommerce sectors[4] in the UK are:

- Fashion, Clothing and Textile (13%)

- Household Goods (7.1%)

- DIY, Furniture and Home Furnishing (5.2%)

- Sports Equipment, Games and Toys (4%)

- Beauty and Cosmetics (1.8%)

Overview of Top Performers and Sector Trends:

- Fashion, Clothing and Textile: Top performers are ASOS, Next plc, Amazon Fashion, Shein, and Vinted. Growth is slowing but remains positive: eMarketer points to sales growth stabilizing rather than accelerating. We estimate 2–4% revenue growth — possibly higher in volume terms due to increased demand for low-value products. ONS confirms stagnation in total retail (digital + physical).

- Household Goods: Top performers are Amazon, OnBuy, Sainsbury’s Group (Argos), John Lewis & Partners, Ikea. The sector is suffering from declining household purchasing power. There is a trend toward responsible purchasing, including recommerce. For new products, consumers often prefer an in-store visit or showroom experience before buying online[5].

- DIY, Furniture and Home Furnishing: Top performers are Amazon, Ikea, Dunelm, Kingfisher (B&Q, Screwfix, Wikes), Temu. Amazon and Ikea dominate the sector, but newcomer Temu is proving disruptive, offering a vast range of low-cost items and launching initiatives with local suppliers for fast delivery[6].

- Sports Equipment, Games and Toys: Top performers are Amazon, Decathlon, Argos, Sports Direct, Smyths Toys. The Sports Equipment segment is outperforming the Games and Toys one. Purchases are typically driven by promotional periods. In sports, try-before-you-buy remains essential for technical items, whereas online shopping is common for consumables.

- Beauty and Cosmetics: Top performers are Amazon Beauty, Boots, THG Beauty, TikTok Shop. This is the UK’s most dynamic eCommerce sector, with double-digit growth. TikTok Shop is now the 4th-largest beauty sales channel in the UK (Reuters), with one product sold every second. Social commerce — expected to more than double between 2024 and 2028 — is a major driver, thanks to influencers’ role.

[1] Adjusted for inflation (2.5% according to official data).

[2] Names listed in alphabetical order – not indicative of performance ranking.

[3] https://www.dhl.com/global-en/microsites/ec/ecommerce-insights/insights/e-commerce-logistics/2025-out-of-home-trends.html

[4] Excluding Food – which rarely translates into parcels.

[5] https://www.linnworks.com/wp-content/uploads/2024/02/Home-and-Garden-Consumer-Survey-report-2024-Linnworks.pdf

[6] https://www.thetimes.com/business-money/companies/article/temu-uk-chinese-shopping-app-cpr568pf6

For more in depth information on French CEP Market, please refer to our Country CEP Market Report Section. Special discount for CEP Research subscribers !