DEVELOPMENT OF POSTAL SERVICES TO BETTER REFLECT E-COMMERCE CUSTOMER NEEDS

Read also …

EFFIGY CONSULTING RESEARCH FOR UNIVERSAL POSTAL UNION (UPU) – POSTAL SERVICES FOR E-COMMERCE

Published on 08/08/2024 by the Universal Postal Union

Effigy Consulting was mandated by the UPU (UN agency for cooperation between postal sector players) to carry out a market study on postal products for e-commerce.

This research was an opportunity to qualify changes in customer needs and uses (weight, size, delivery time, delivery service, etc.), and raise recommendations on the development of new cross-border physical postal services on e-commerce.Particularly, this research highlighted questions about the current terminal dues, and their relevancy regarding the last-mile market reality (leading to challenges for import countries).The study also emphasizes the growing importance of adhering to data regulations in the exchange of consumer data between operators.

Executive Summary

The aim of this research was to understand factors influencing the use of postal products for e‑commerce shipments, distinguishing between weight categories above and below 2 kg. The study, based on 28 interviews, reveals challenged standards for postal parcels, especially in terms of weight, dimensions and remuneration rules. New-generation carriers are gaining market share with alternative last-mile delivery methods, such as lockers.

Particularly, this research highlighted questions about the current terminal dues, and their relevancy regarding the last-mile market reality (leading to challenges for import countries).

The study also emphasizes the growing importance of adhering to data regulations in the exchange of consumer data between operators.

The challenge of revenue distribution in the e-commerce value chain is crucial, prompting a need to review margin distribution. Surprisingly, environmental impact is not a primary concern for DOs, but the study advocates for greener logistics across the supply chain.

The research underscores the postal industry’s need to adapt to evolving e-commerce demands, urging the UPU to focus on high-quality service, pricing and the development of products meeting retailer needs. While the study does not propose expanding the 2 kg limit for small packets, it identifies challenges in improving tracking and delivery times. The price of small packets, while advantageous to the origin DO and its customers, may not be as viable for the destination DO and must be supplemented to meet the demands of B2B2C operations. The interviews also highlighted the need for improvements to the rules on DO exchange processes and the UPU regulations on data privacy, protection and management.

E‐commerce revenue by region from 2017 to 2027 in billion SDR

Develop physical services to contend with supply chain disruption

Based on this study, it is recommended that postal operators develop physical services that can effectively counter or contend with future disruption to the global supply chain, similar to that witnessed during the COVID-19 pandemic.

To address volume decline during the suspension of import/export chains, the following strategies are proposed:

-

Incorporate the international postal transportation network into critical infrastructure plans;

-

Utilize the UPU and network of postal partners to coordinate shuttle transportation in cases where point-to-point co-loading is no longer feasible. For instance, if commercial uplift from China to Belize is suspended, organize postal air shuttles from China to Belize, Aruba and Suriname;

-

Identify business opportunities arising from supply chain disruption, such as offering temporary transportation for goods that are in demand but not typically accepted, such as prepared meal kits, COVID tests and face masks.

To address the shortage of technical resources necessary for daily operations (e.g. handheld scanners, batteries and spare parts), postal operators can maintain a stock of critical parts and resources, including commodities such as disinfectant and face masks. This ensures resilience against potential shortages and disruptions.

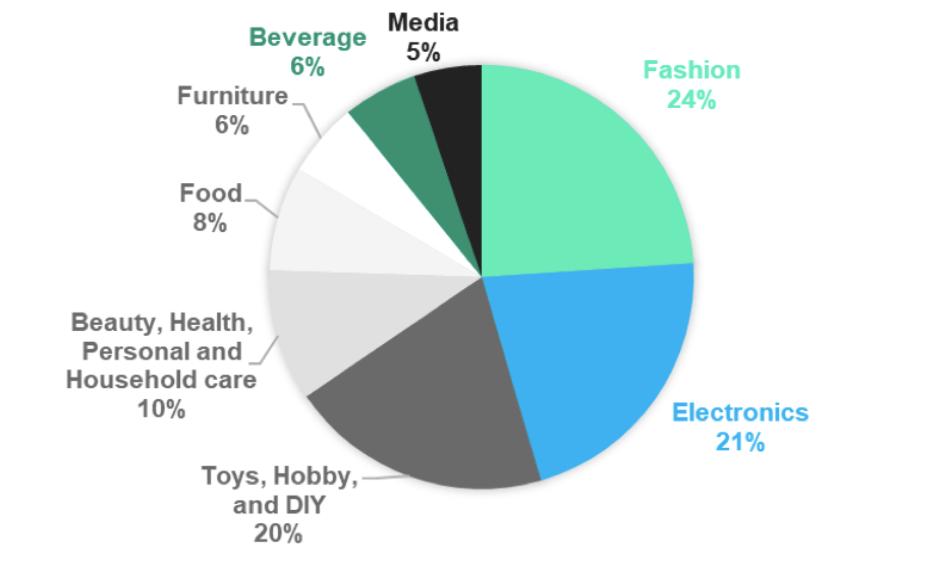

Market share of e‐commerce segments

Improve competitiveness of UPU products by adjusting the value/price proposition

The study reveals that, in mature e-commerce markets, the postal network faces challenges in cross-border competitiveness. Origin-based pricing and single-item customs handling contribute to this issue, leading to high margins for the origin company and little incentive for quality delivery by the handling company. Current item level customs handling incurs high costs for each parcel, while supporting bulk customs clearance offers a competitive advantage. Proposing this model through the UPU could enhance the economic attractiveness of international postal products to e-tailers.

E-commerce products, typically under 2 kg, require similar delivery times and tracking services as larger parcels, but are subject to cost pressures, often being offered at or below actual costs. While small packet products are cost-effective, they provide fewer features. The challenge is to develop a product that is competitively priced while delivering high-quality services and features.

The exchange of customer details and parcel data is subject to challenges owing to data protection regulations, and the decision-making cycle for the UPU and its members may lag behind rapid market transformations. Developing new services and products is crucial, but the diverse interests and local needs of postal operators present challenges. Self-declared rates pose difficulties, prompting various efforts to counteract them. Moreover, there are challenges with regard to other international products owing to misaligned terminal dues and a lack of tracking for UPU letter post (E format). The emergence of B2B2C models limits direct international parcel shipping, leading e-tailers to opt for bulk shipments for streamlined customs clearance and reduced shipping costs.

Evolution of DO volumes below and above 2 kg

Support e-commerce growth by providing responses to the new expectations of e-merchants

In the current economic landscape, the postal industry is confronted by diverse challenges that must be addressed in order to develop a product that is competitively priced and offers high-quality service features. The fashion and electronics segments are projected to constitute 46% of the market in 2027, with the beauty, health, personal and household care segment expected to grow by 11% annually. These segments, which are primarily composed of small items, will drive demand for small packets, making it necessary for carriers to provide tailored solutions that align with the expectations of e-tailers and their customers in terms of speed, tracking and pricing.

The UPU is urged to introduce a new product line that utilizes the physical aspects of the letter post for goods product line, offering greater price flexibility and focusing less on dimensions. This new line should incorporate processes similar to EMS, ensuring best-in-class service in terms of delivery speed and tracking, with up to 29 scanning events. As implementing this product line requires IT-intensive processes that are currently unavailable in all member countries, preparation will be necessary, along with measures to encourage widespread adoption to maintain consistent global standards.

For products exceeding 2 kg, the existing EMS system provides top-quality service at a competitive cost compared to international competitors. No substantial improvements are required, with the exception of global availability for all destinations.

The UPU, having established valuable processes and standards for international postal exchanges, possesses a distinct advantage over new players in terms of customs clearance and essential information for international exchanges. Leveraging this knowledge positions the organization as a key player in the evolving international e-commerce market.

For more in depth information about Parcel Market Insights, please refer to our CEP Market Data Analytics Section.