2025 France Parcel Delivery Market Outlook

Read also …

2025 France Parcel Delivery Market Outlook

Published on 19/06/2025

Thanks to CEP-Research GmbH for publishing our analysis of the parcel market in France 📦📦 !

Looking ahead to 2025, projections from we anticipate a revenue 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐠𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝟱.𝟴% 𝐟𝐨𝐫 𝐁𝟮𝐂+𝐂𝟮𝐗 (split by segments available upon request) —a marked improvement over 2024’s 4.1% Revenue growth, achieved in a macroeconomic environment of 2.3% inflation (forecast to drop to 1.3% in 2025).

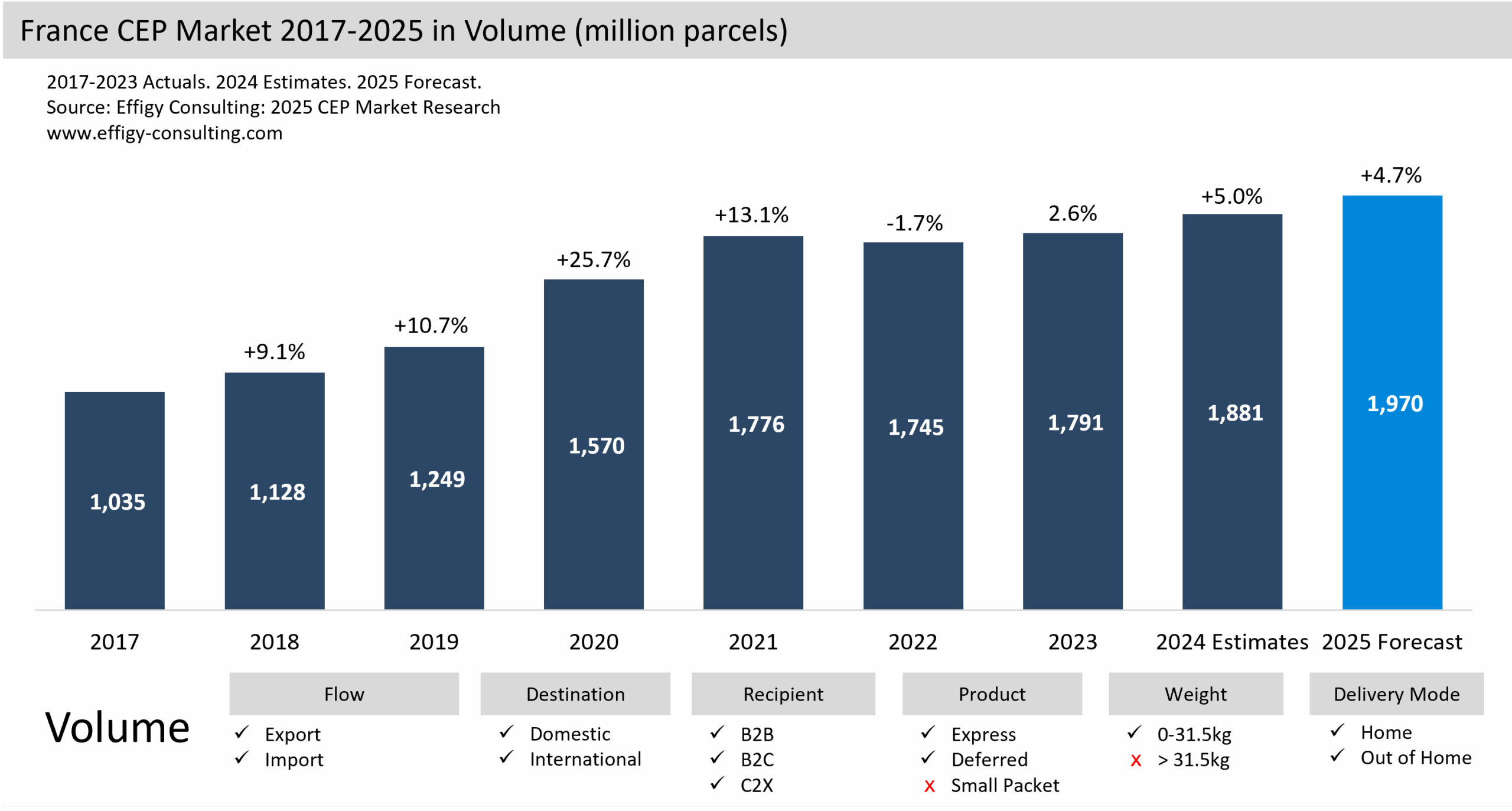

The French parcel market recovered well in 2024 and is set for continued single-digit growth in 2025, according to research by Effigy Consulting.

2024 signalled a clear rebound for the French eCommerce market, with revenues from physical goods growing by 6%[1], suggesting a nearly 4% increase in volumes. This performance aligns France with the broader European trend, where the average compound annual growth rate (CAGR) for eCommerce revenues across the 2024–2028 period is projected at 6.17%[2] (for physical goods only), corresponding to a 3.99% volume CAGR.

E-commerce developments

eCommerce’s share of total retail sales rose to 11% in 2024, reaffirming its embeddedness in consumer behaviour and highlighting a growing divergence in momentum between physical retail and digital commerce.

This accelerating shift from brick-and-mortar to online is symptomatic of deeper structural challenges facing traditional retail—challenges that have seen established names such as Camaieu, Naf Naf, Minelli, Esprit, and Jennyfer struggle (or collapse).

The phenomenon has been further exacerbated by the meteoric rise of Chinese marketplaces such as TEMU, and SHEIN – platforms whose growth, while impressive, raises both economic and social questions.

In response, some retailers have shuttered physical outlets to recalibrate their strategy; Zara, for instance, has closed several stores in France to refocus on strategic locations and bolster its online footprint.

eCommerce Delivery: Growth and Competitive Realignments

Looking ahead to 2025, projections from Effigy Consulting point to a 5.5% growth in eCommerce revenues for physical goods, and a 3.1% rise in volumes. Based on our proprietary multivariate models, we forecast that B2C parcel delivery Revenue will outpace this slightly, with an anticipated revenue growth of 5.8% for B2C+C2X (split by segments available upon request) —a marked improvement over 2024’s 4.1% Revenue growth, achieved in a macroeconomic environment of 2.3% inflation (forecast to drop to 1.3% in 2025).

Early 2025 market signals and conversations with industry players indicate that several verticals are poised for double-digit growth, notably pharmaceuticals, healthcare, household essentials and furniture, and beverages.

Carrier trends

Several delivery players are also expected to post double-digit growth figures in 2025. These include DPD, Mondial Relay (InPost Group), Paack, and Star Service—operators that already achieved revenue growth rates between 11% and 26% in 2024 (split by carrier and segment available upon request). Meanwhile, Amazon Logistics, which has posted robust growth in France over recent years, is anticipated to return to single-digit growth, albeit still ahead of the market average.

Marketplaces and Retail Rankings: A Landscape in Motion

These figures echo the findings of a recent Fevad (French eCommerce and Distance Selling Federation) survey on merchant sentiment, which gathered insights from 227 senior executives across France, Belgium, Italy, Germany, and Spain. Over two-thirds of respondents expressed a stable or optimistic outlook for 2025.

In fashion—France’s leading eCommerce vertical—Amazon maintained its dominance in 2024, attracting 25.5% of online fashion shoppers, followed by Lithuanian-based Vinted (18.5%) and China’s SHEIN (16.8%). Decathlon and Zalando retained their strong positions, while Temu climbed three spots in the rankings. Vinted remains the top platform for Gen Z fashion, while Kiabi leads in children’s apparel[1].

Beyond fashion, other sectors also saw dynamic shifts, per Fevad data:

- Sports: Decathlon leads with 30.1% of market share, followed closely by Amazon (29.6%) and Nike (16.8%). Intersport and Adidas round out the top five. Temu’s ascent continued, leaping ten places to claim the 9th spot.

- Beauty: Amazon and Yves Rocher are neck-and-neck at 23.5%, followed by Sephora (19%), Nocibé, and Marionnaud.

- Second-hand goods: A booming category, with 43.9% of French consumers making at least one purchase in 2024. Vinted leads (21.8%), ahead of LeBonCoin (18.7%) and Amazon (12.8%), followed by Rakuten and eBay. This surge is reflected in C2C parcel delivery growth, which reached 11.2% in 2024 and is expected to maintain double-digit momentum in 2025.

Cross-border Trade: Growth Meets Geopolitical Headwinds

International expansion remains a strategic lever for French eMerchants, with Belgium, Spain, and now Germany (which overtakes Italy) among the preferred destinations. However, the “Greater International” space—beyond Europe—presents heightened uncertainty amid a complex geopolitical and regulatory climate. Exporters face unstable U.S. tariffs, while importers brace for possible reciprocal measures, particularly targeting Chinese goods. The interest of Chinese sellers in Europe may intensify further due to the trade tensions between Beijing and Brussels.

In this context, recent French government announcements in May 2025 are particularly notable. Among the proposed measures: the implementation of per-parcel management fees from 2026 to 2028. The timing aligns with the EU’s forthcoming removal of the VAT exemption for goods imported under €150, designed to bridge the regulatory transition period ahead of broader harmonization.

eCommerce Performers in 2024

- Amazon: Remains the top eCommerce player with 36.2% market share by customer count. Increasingly, Amazon handles its logistics in-house, making it the third-largest parcel operator in France—a shift that structurally reduces volumes for third-party carriers.

- TEMU: France is now its second-largest European market, with 12 million monthly recipients. By late 2024, La Poste CEO Philippe Wahl reported that TEMU and SHEIN collectively accounted for 22% of the group’s parcel volumes, surpassing Amazon and up from just 5% five years ago.

- SHEIN: Generated €1.63 billion in revenue in France in 2023, outpacing established players like H&M and Primark.

- Vinted: Achieved remarkable growth in 2024, with revenues rising 36% to €813 million and net profits quadrupling to €77 million. The platform now captures 12.6% of fashion eCommerce volumes in France (Kantar, H1 2023), ahead of Amazon (9.1%) and SHEIN (8.4%).

- LeBonCoin: Noteworthy for its surge in traffic, reaching 29.6 million unique monthly visitors in Q4 2024.

Delivery Modal Shifts: Lockers Gaining Ground

Home delivery continues to dominate, representing 70% of volumes, while parcel lockers now account for an estimated 6–8%—a segment growing well above the market average. This rise suggests a clear substitution effect, particularly at the expense of traditional pick-up points. Mondial Relay’s decision to close 3,500 partner locations—local merchants previously handling 40 to 80 parcels per day—illustrates this transition.

Fevad’s 2024 study underscores that price remains the top determinant in standard home delivery choices, with 55% of regular users prioritizing free delivery. Speed (27%) and tracking capabilities (25%) follow. These consumer preferences could further accelerate locker delivery adoption, where we anticipate sharper price differentiation. From the carrier’s perspective, the cost efficiencies derived from consolidated drop-offs at a single location are substantial and increasingly strategic.

For more in depth information on French CEP Market, please refer to our Country CEP Market Report Section. Special discount for CEP Research subscribers !