THE TURKISH CEP MARKET, A NEW PARCEL ELDORADO?

Read also …

THE TURKISH CEP MARKET EVOLUTION

Published on 06/11/2023

Effigy Consulting is thrilled to announce that Philippe Masquelier, its CEO, was interviewed by CEP Research on the Turkish Parcel market.

Turkey has emerged as one of the top growth markets for CEP carriers thanks to a strong manufacturing base, dynamic e-commerce expansion, a prime geo-strategic location, numerous foreign investments, and other factors. After double-digit growth in 2022, the outlook remains very positive for the coming years, according to a new report from Effigy Consulting.

Please find below detailed figures from the Effigy Consulting report and analyses of key developments in the market.

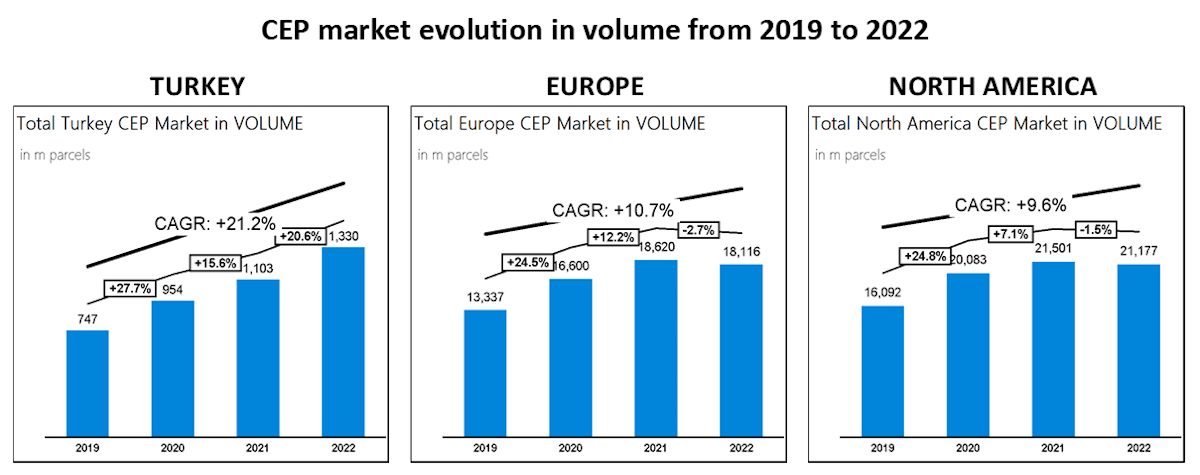

The recently released results of our new Turkey CEP (Parcels) Market Report demonstrate strong volume growth of more than 20% in 2022, in stark contrast to Europe and North America whose markets decreased by -2.7% and -1.5% respectively. Note that the revenue of the Turkish CEP Market expanded rapidly in 2022 by more than 80% with high inflation driving much of this increase.

In Turkey, pan-European carriers (Geopost, Austrian Post Group), integrators (DHL, UPS, FedEx) and major eTailers (Amazon, Alibaba) are strengthening their presence and operational capabilities in the country through M&A and strong investments in infrastructure.

What are the main drivers of such interest and growth?

Turkey’s strategic location and resilient manufacturing base make it a prime candidate for becoming a major e-commerce hub. Carriers and eTailers are investing in Turkey to capitalize on its strong local textile industry and growing e-commerce market. Recurring problems with ordering goods from China due to COVID and supply chain disruptions between East and West have further accelerated this trend.

Turkey is also an attractive local market, with 91.3% of the country’s e-commerce revenue realized domestically, whereas e-commerce exports and imports represent, at the moment, only 4.2% and 4.5% respectively. The Turkish e-commerce market (goods and services) is estimated to have grown by 109% in 2022 to a value of 800.7 billion TL (up from 381.5 billion TL in 2021), with e-commerce representing 18.6% of total retail (vs. 17.7% in 2021) (Source: E-ticaret Bilgi Platformu, October 10, 2023).

According to the Amazon Turkey SME E-Commerce Outlook Survey, cross-border the key markets for e-commerce exports are Europe (40%), Middle East (35.3%), Africa (16.6%), Asia-Pacific (5.7%). The majority (71%) of e-commerce companies trading cross-border use marketplaces, whilst 39% rely on or have some cross-border handled via their own websites.

Which international companies are investing in Turkey?

As mentioned above, parcel carriers, integrators and e-commerce companies are all investing in the country. Here are some examples from the CEP sector:

- Geopost (part of Groupe La Poste) has stakes in Yurtiçi Kargo (the market leader by revenue) and in Aramex, which are both very active in the Turkish parcel market. Yurtiçi Kargo has announced 1 billion TL in operational projects over the next year including two large, automated transfer centres. Aramex is a key player in International Export and Import Express.

- Austrian Post Group has a major stake in Aras Kargo and is investing strongly in their infrastructure.

- DHL has just acquired one of the main domestic carriers, MNG Kargo, which is also the local partner of GLS.

- FedEx/TNT is building a new global air transit facility at Istanbul Airport, a strategic location connecting six continents.

- UPS has been adding flights: Turkey was a link between the east and the west for them, and now it has become a very important central base for connections between north and south, Africa and the Caucasus.

- Other carriers are growing, such as Sürat Kargo who has benefited from venture funds and is now growing again following poor results in previous years.

In addition, e-retailers such as Alibaba and Amazon are strengthening their operational capabilities in the country. For example:

- Alibaba has announced a 1bn$ investment in Trendyol Express (the market leader in volume).

- Amazon works locally mostly with Kolay Gelsin and is developing its Turkish Marketplace with a focus on export to Europe and the US.

- Hepsiburada, one of Turkey’s main e-commerce marketplaces, has its own logistics company ‘hepsiJET’.

- Koç Group, a very large group in Turkey active in many sectors, has set up its own delivery capabilities through Sendeo (launched in 2021 and expected to grow fast).

What does the Turkish CEP market look like in detail?

In 2022, the Turkish CEP market is estimated to have reached a revenue of €1.75 billion, growing by more than 80% vs. 2021, and a volume of 1.33 billion parcels, growing by more than 20%. The domestic market has grown in volume by more than 20% and the international market by almost 15%. The B2C/C2X market has grown by almost 30% whereas B2B has decreased by more than -5%.

The main carriers are ranked as follows:

|

In Revenue for 2022

|

In Volume for 2022

|

Note: Sendeo (Koç Group) is currently under Rest of market but should be moved to the carrier list in 2023 thanks to high growth.

Following this impressive growth and with strong underlying factors, the future growth of the Turkish CEP market is expected to be much higher than in Europe and North America thanks to the continued boost from e-Commerce and the expanding international flows.

For more in depth information, please refer to our Country CEP Market Reports Section.