UKRAINIAN CEP MARKET REPORT 2023

Read also …

UKRAINIAN CEP MARKET REPORT – THE LATEST INSIGHTS

Published on 11/08/2023

Effigy Consulting, in collaboration with Last Mile Experts, has just completed an assessment of the 2023 Ukrainian Parcel Market on 2022 Actuals.

Effigy Consulting has just released a detailed analysis of the Ukrainian Parcel Market in collaboration with Last Mile Experts and the following partners: GLS Poland, Modern Expo, Nova Post Polska, Zebra Technologies and Statista.

It provides a description of the situation on the Ukrainian CEP market and a detailed analysis of volumes, as well as market shares per segment and carrier.

Despite a tragic war in Ukraine resulting in a highly challenging geopolitical situation, the Parcel Market was able to remain very active. The continued activity of parcel carriers has been vital for Ukrainians: first by helping relocate key activities to ‘safer’ areas of Ukraine, and second by enabling the people to send/receive goods both within the country and cross-border.

E-commerce remains an important pillar of the Ukrainian economy, enabling people to have access to goods. It is interesting to note that electronics and fashion still represent more than 50% of the Ukrainian e-commerce market, whereas healthcare has become a strong segment.

As a result of the hostilities, most small companies have suspended operations or disappeared from the market altogether. Nova Post, Ukrposhta and Meest have remained very active in both 2022 and 2023 and have found increasing demand for speed of delivery and Premium services. After the outbreak of the war, most companies from the CEP sector joined humanitarian or military transport operations. We anticipate that as soon as the war ends, building on an already robust trend, C2C will also become a significant factor in terms of volume growth.

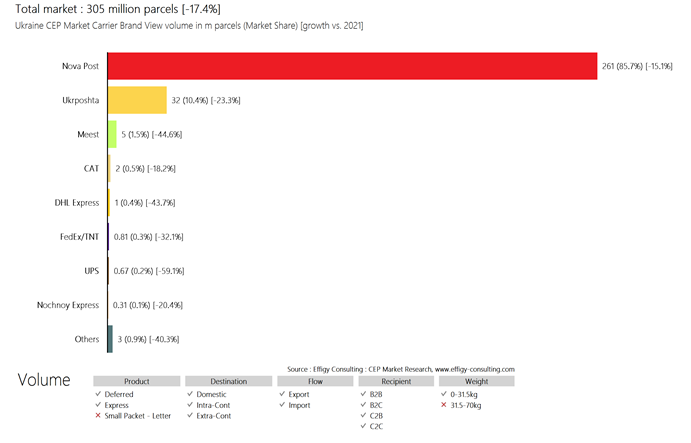

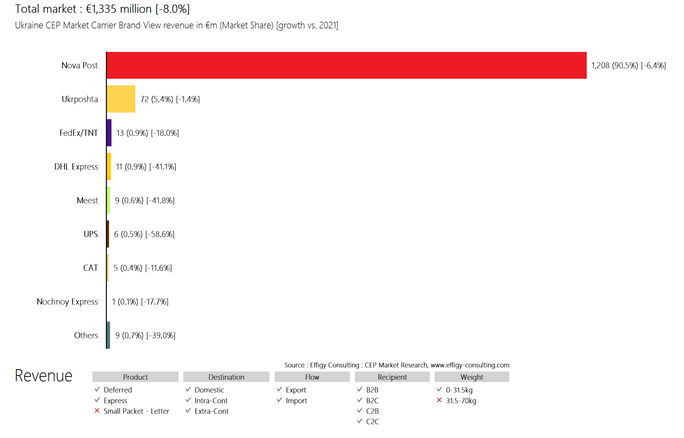

It is estimated that the drop on the Ukrainian CEP Market for 2022 was of only -8.0% in revenue and of -17.4% in volume.

The market leaders in terms of volume in 2022 are Nova Post with 261m parcels with a market share of 85.7%, followed by Ukrposhta with 32m parcels with a market share of 10.4% and Meest with 5m parcels and a market share of 1.5%.

TOTAL 2022 UKRAINIAN MARKET BY CARRIER BRAND VIEW (IN REVENUE)

2022 UKRAINIAN CEP MARKET in revenue, split by Carrier brand view.

TOTAL 2022 UKRAINIAN MARKET BY CARRIER BRAND VIEW (IN VOLUME)

2022 UKRAINIAN CEP MARKET in volume, split by Carrier brand view.